Going Galt

A certain Professor Xxxx has received quite the internet thrashing for complaining that (cached version) — despite a household income (roughly $450K $400K ) nineeight times the median US household income — he’s really just an ordinary Joe, trying to make ends meet, and will suffer terribly if Congress allows the Bush tax cuts (on incomes over $250K) to expire.

I’m somewhat loath to pile on, as surely every cognitive flaw, exhibited in the post in question, has been more than amply exposed. But something struck me about one of his followup posts (cached version), which seems to speak to a more general bit of nonsense that one hears from those of Professor Xxxx’s ideological persuasion.

He says

So why doesn’t Prof. Krugman say that I’m a whiny loser because I’m complaining that the government needs 50% of the money I spend each month, on things like art camps? It may be that some of the decisions I made that led to these fixed costs were mistakes, but there will be a real impact from this increase in my tax burden. I’ve not seen any critic point out why my Polish-American house cleaner would be better off getting handouts from the government than earning her wage cleaning our house.

Now, arguing that your taxes shouldn’t be raised because, if they are, you’ll respond by employing fewer domestic servants, is probably not the winning sort of argument that a University of Chicago Law professor would teach his students to marshall. But let’s leave that aside. What I want to focus on is the fact that art camp, for apple-cheeked Amy is in peril. Two paragraphs later, he says

Fifth, lost in all of this is the impact of increased taxes on the work-leisure tradeoff. As marginal taxes rise, so does the disincentive to work. I’m asked with some frequency to write, consult, or testify, and when I do, I face the question of whether the effort and time is worth it. I can choose to watch the Steelers or help a hedge fund with a corporate law question. The higher my marginal taxes, the more likely I am to choose the former. This is a losing proposition from a social welfare perspective, no matter what you think of the quality of my advice or the role of hedge funds.

Let’s understand what’s being said here.

If his marginal tax rate is raised from the current 35% to 39% (the rate that prevailed during the Clinton Era), art camp for apple-cheeked Amy will become unaffordable. But, rather than take on that additional consulting gig (which, after taxes, would net him $122/hour, instead of $130/hour) to pay for Amy’s art camp, Professor Xxxx plans to sit on the couch watching football.

Is that really how Professor Xxxx plans to meet this (alleged) financial challenge? If so, he truly does inhabit a different psychological universe. Most of us, when cash-flow gets tight, try to find ways to increase rather than decrease our income.

But, really, who (except for the Xxxx’s) cares whether apple-cheeked Amy gets to go to art camp? What really matters to the rest of us is Professor Xxxx’s contributions to the overall economy. Is it really true that he (and others in his position) will park himself on the couch, watching football, instead of contributing productively to the economy?

Is it really true that raising the top marginal tax rate will hurt GDP, because people like Professor Xxxx will work less hard in response?

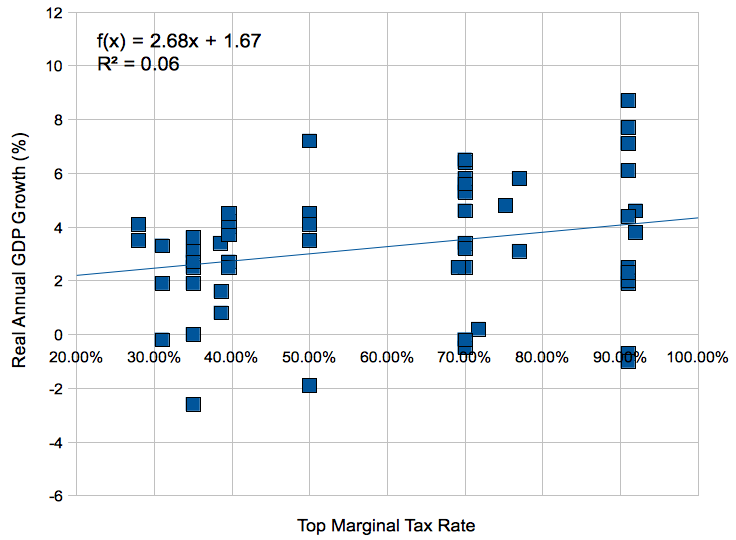

A simple test of this hypothesis is to plot top marginal tax rate versus real GDP growth, 1950-present. That’s 60 years worth of data, during which the top marginal tax rate varied between 92% (in 1952-1953) and 28% (in 1988-1989).

Surely, if Professor Xxxx is right, we should expect a negative correlation between real GDP growth and the top marginal tax rate.

Scatter Plot of Annual Real GDP Growth vs Top Marginal Tax Rate, 1950-2009

As you might expect, there’s a lot of scatter in the data, but there is no evidence of a negative correlation between the top tax rate and economic growth. If anything, a linear regression fit shows a positive correlation (albeit, with really crappy R2 of 0.06).

As Brad Delong points out, the CBO comes to the same conclusion about the ineffectiveness of upper-income tax cuts in stimulating aggregate demand.

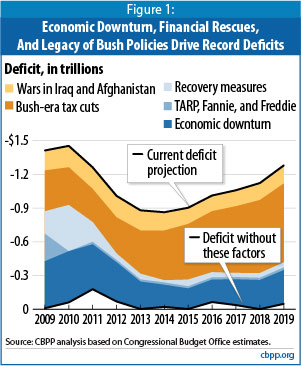

On the other hand, that the Bush-era tax cuts are the major contributors to the projected deficits in the decade to come is pretty clearly established.

Contributions to the budget deficit over the next decade

Next to keeping Republicans out of office, letting the Bush tax cuts expire is the best thing we could do for the long-term budget outlook.

Re: Going Galt

Hi,

Having been one of those who bugged you to post some (any) graphical representation to the cold, hard, math in this yarn of your blog, THANK YOU!

See, cold, hard math has this quality of being …well, how shall I put it? Cold and hard come to mind. So, when I am trying to convince some of my mathematically challenged acquaintances that they are voting against their own best interests, graphs like these really, Really, REALLY help. THANKS!!!

In turn, your post did prompt me to look up the ‘blog-wave Prof. Xxxx created, only to realize that it is the same line of “argument” Ben Stein used this Sunday (Sept. 19) on CBS’s “Sunday Morning Show”. So I did read up what Prof. Xxxx had so say, and find him saying things such as:

“The nanny is a must for two-income couples with kids.”

Well, if it is a MUST, than ALL two-income couples with kids should (afford to) have them, or else the system is not fair; plain and simple. Right? RIGHT?

Homework to your Readers:

(1) Estimate the total number of two(or more)-income couples with kids in the USA. (I’m not sure that the average family still has 2.3 kids, but that’s a good starting point.) Now, (2) estimate the number of two(or more)-income couples with kids in the USA who actually afford to hire a nanny. (3) Compare the two results and explain the difference.

Alas! Prof. Xxxx either truly believes his own mantra, or has never done math beyond what can be accomplished on fingers of one hand.

The moral to my post: folks, learn how to convince your mathematically challenged (or, innumerate, as John Allen Paulos would call them) friends, neighbors and acquaintances! For, if you don’t, they most likely will vote against their own (and most likely also your) interests.